Microinsurance

A low transaction cost insurance distribution platform and concept to:

- Address rising competition in the industry;

- Help to get faster insurance penetration (especially in emerging countries) and allow access to insurance for lower income groups;

- Find new & innovative distribution channels for simple-risk products;

- Leverage on utility- and retail companies’ existing customer base and ecosystem;

- Use of technology and optimized processes to enable economically frequent & small transactions.

Streamline the process of selling simple-risk insurance products (like travel, accident, home, motor) using mobile apps, portal and SMS as customer user interface.

Functionality

The high level functionality covers:

- Underwriting, policy creation;

- Call center tool for user support;

- SMS as User Interface for convenient buying process and support;

- Mobile app for insurance buying, emergency, claims notification and additional services;

- Web Portal for customer information, buying process and claims;

- Interfaces to mobile operator and utility billing systems;

- Interface to insurance company for policy data transfer.

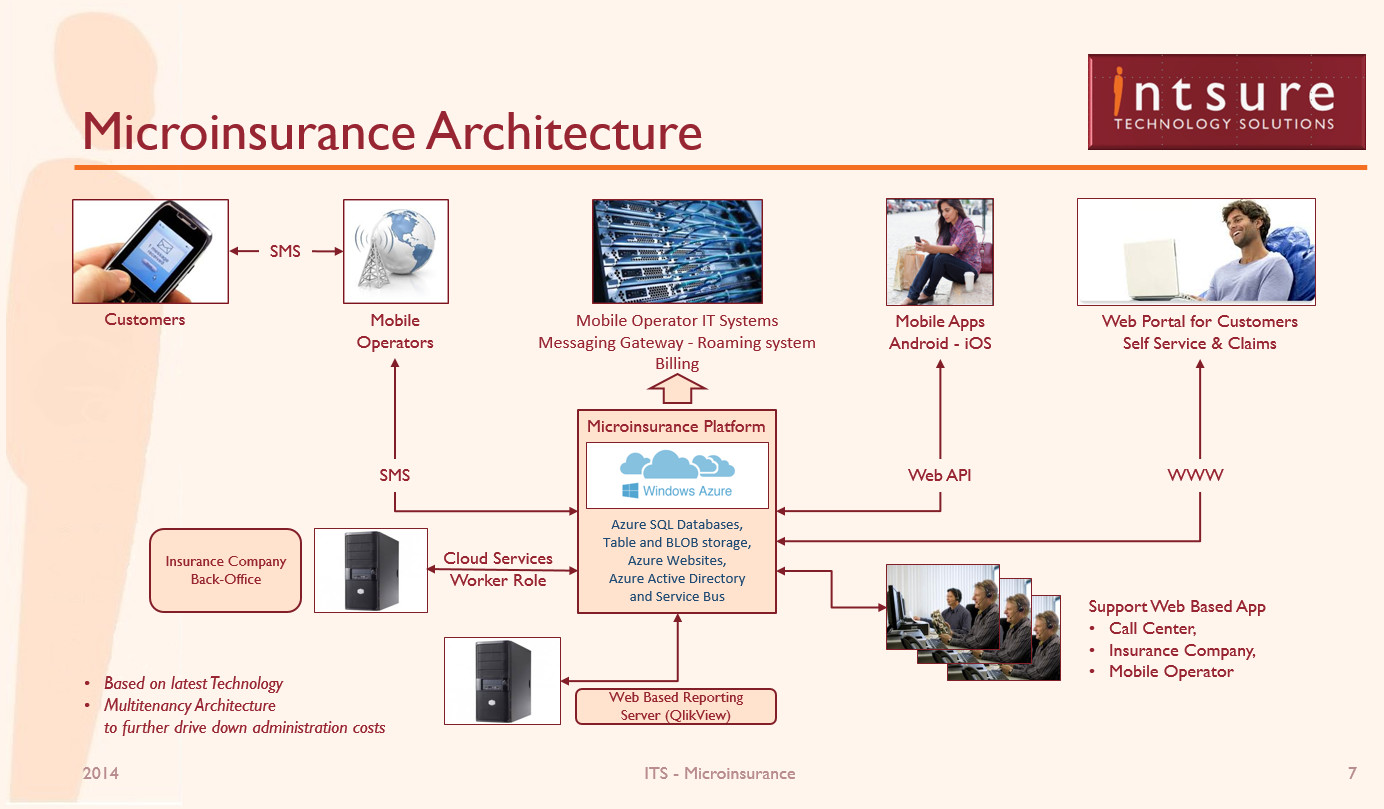

Architecture

Business Examples

- Utility companies in the UK are leading the pack;

- Travel insurance via SMS, Premium collection via Telecom Company bill (Baltics);

- Unemployment insurance with mobile operator (Hungary);

- Extended warranty on gadgets;

- Accident and life insurance via SMS (South Africa).

Usage Scenarios

- Mobile operators. Selling insurance to mobile operator customer base, using SMS, Mobile App and Customer portal;

- Utility companies (electricity, gas, cable TV) with large customer base, willing to expand on services and earnings from existing portfolio;

- As microinsurance channel infrastructure for an insurance company;

- Mobile App as sales interface. Platform can be used in «Mobile app only» mode, where insurance sales is done using app, customer portal for post-sale and Support application for call center.

For more information about the Microinsurance Platform or the Concept you can contact: ewout@sunfieldconsultancy.com.