InsurTech - Charge and Accelerate A view from above on InsurTech Comparing Industries As Automotive Engineer and International Insurance & Claims Manager I’m close to both the Car and the Insurance industry. Looking at what’s happening from a change perspective there is no bigger difference conceivable!

Blog

Intelligent Insurance for Smart Living Insurers are aware that technology will help to reduce claims drastically and therefore finally run premiums down to unsustainable levels. Insurance. Time to move on “Insurance is a cornerstone of modern life. Without insurance, many aspects of today’s society and economy could not function. The insurance industry provides the cover for economic, climatic, technological, political and demographic risks that enables individuals to go about their daily life and companies to operate, innovate and develop.” Source: Insurance Europe

Approaching the peak Are Aggregators here to stay? A conclusion concerning Aggregators (aka Comparison Portals) in the Accenture Distribution and Agency Management Survey is: “Irrespective of insurers’ views on the role of aggregators, it seems they are here to stay”. This is supported by many others and nevertheless I venture to doubt. It could very well be that the aggregator business is nearing a tipping point.

Successful initiatives in Insurance? Ten years ago BlaBlaCar was founded and now is a trusted community marketplace that connects drivers with empty seats to passengers looking for a ride. With 25 million members in 22 countries. Where BlaBla means “can be chatty”. It’s one of the many so far successful initiatives using technology to bring together supply and demand. What about insurance initiatives?

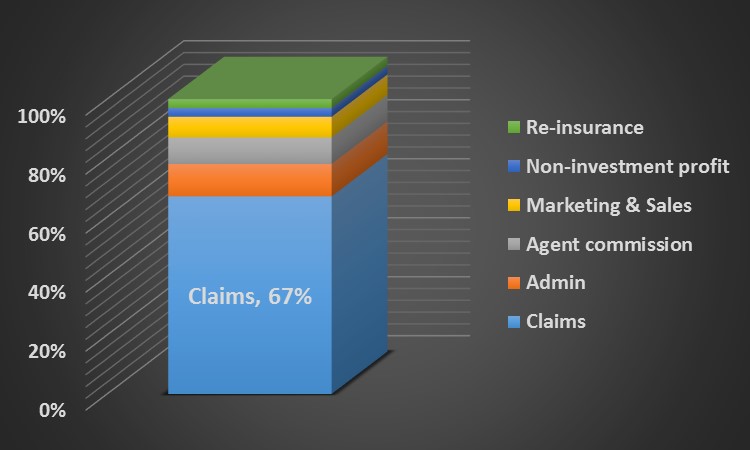

Bringing Claims Management to the Next Level. The core of insurance is claims. In Non-Life (P&C) on every € 100 insurance premium paid on average € 67 is to compensate for claims (including expenses), for which the premium ultimately was paid. One third (€ 33) of the insurance premium is used to do the job. Getting this Claims Flow well under control is really making the difference. Not only financially but also for customer satisfaction and retention.

Vehicle and information technology will reduce claims in the next 2 decades by about 80% and/or transfer liability to others than the driver. See also a previous post. Existing products and business models won’t work anymore. This is however not the dead-end street I’m referring to in this post. Of course this will go gradually and in the next coming years we can continue to work on new business models. Although…. I expect another dead-end street on the shorter run.

Last Tuesday (28/04/2015) the EU voted on the eCall in-vehicle system. Outcome was that eCall (the emergency call device that automatically alerts rescue services to car crashes) will have to be fitted on all new models of cars and light vans by 31 March 2018.

Note: A next post will be on Data-driven Business (with quite some similarity). Amongst the many milestones in the area of autonomous driving coming from all possible angles we now have the Delphi Drive. From coast to coast in the US, 5500 km self-driving*. At the moment of writing this post we are at the start of day 3 and the car did the first 1200 km without issues.

Yesterday (March 17, 2015) the European Parliament’s Internal Market and the Consumer Protection Committee voted again to mandate eCall technology. With 26 for and 3 against.

Today Google launched in the US a new feature to sell car insurance to web searchers. (See also my post from February 18). In the UK Google’s comparison site is in operation since 2012 but a launch in the US has been delayed several times. Google is launching now in California with plans to roll-out to other states later this year.

The core of insurance is claims. In Non-Life (P&C) on every € 100 insurance premium paid on average € 67 will be plowed back into payment of the damage (and expenses) for which the premium ultimately was paid. Is € 33 to pay out € 67 sustainable? This plowing back of the money to the entitled parties takes € 33; one third of the money brought in by the customer.

In August 2002 the production of the original XC90 started and after several upgrades and 13 years Volvo introduced the next generation (XC90 Model 2016).

Google’s Self-driving Car. Google wriggles itself into the insurance arena already for a few years now. And why not, opportunities enough.

Also for motor insurers it is interesting to follow what’s happening within the UNECE concerning the development of a regulatory roadmap for autonomous driving vehicles. There are 2 key Working Parties within the UNECE: WP.29 and WP.1

How does 2015 start from a technology perspective? Some for me relevant developments that will eventually change our life and business models.

We could add “Not all Dutch insurers withstand the EIOPA Insurance Stresstest 2014” regarding the SCR (Solvency Capital Requirement) to the list of issues the Dutch IC’s have to deal with, but we don’t. On top the Dutch Insurance Association has expressed doubts regarding the outcome; so we’ll see.

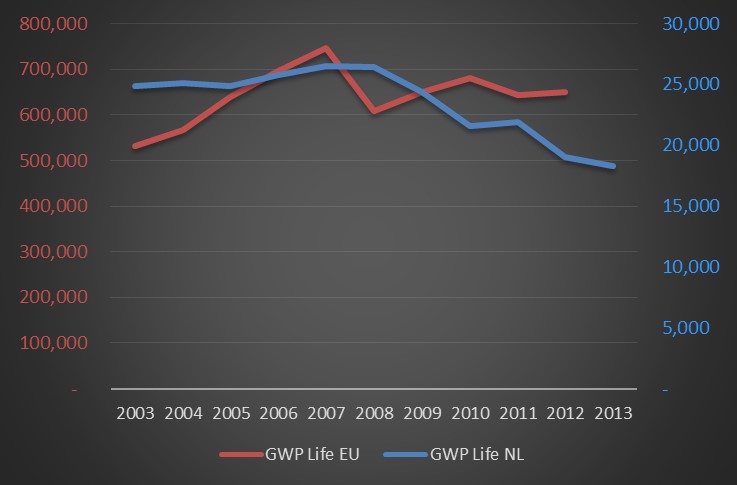

More pressure on Dutch life-insurers. Was my blog on 13 November pointing at the (generic) issue of the shrinking car insurance business, yesterday the DNB (Dutch Regulator) published a report that urges Dutch life-insurers to adjust their business models in order to make them future-proof.

The Dutch insurance industry has been front-runner for decades. The direct channel, claims management, chain integration, communication networks, central databases, preferred supplier networks, fraud detection etc. are good examples where The Netherlands took the lead and outperformed most of the world.

In 2009 I was keynote speaker on an international conference about New Alternative Solutions in Handling Claims and I took the liberty to also put claims into a future perspective. With the ongoing evolution of Road Safety and Vehicle safety the number of claims and the severity will reduce.

Spectrum has posted some amazing video of a “transparent” car created by Japanese researchers.

Some car makers see the HMI (Human-Machine-Interface) as a way to differentiate.

Today also Microsoft launched a fitness tracker. It’s called Microsoft Band and works together with Windows Phone, iOS and Android. Data are stored in Microsoft Health, a cloud service for consumer as well as commercial use. It also teams up with other trackers like Jawbone and Runkeeper and is open for any other party.

Usage-based Insurance (UBI) represents a fundamental change in the way insurance is underwritten, moving away from proxy-based rating models and history patterns to real-life and real-time data analysis.

A view on IoT and some consequences by Barry Rabkin, President Market Insight Group Ltd.

Parts of Strategic Planning are the Mission and Vision Statements. Capturing the reason for being and the values of the organization.

These days in my region the discussion goes on about product liability regarding 3D-printing. Of course there is a certain risk depending on who is printing what and is it private or commercial. One of the stumble blocks in the development of the autonomously driving car is again liability in case of an accident (driver or software?).

An interesting shift in strategy by General Motors. Last week Mary Chan (GM President Global Connected Consumer) announced on the CTIA (The Wireless Association) in Las Vegas that GM will “no longer develop infotainment apps but instead rely on available apps via Apple CarPlay and Google Android Auto”. While so far GM was investing in a dedicated AppShop.

Last Friday I visited BMW in Munich including a Plant Tour.

Although it’s not persé my device I really can appreciate this introduction of the device “that changes the way we live”.

Interpolis (one of the large Dutch insurers and part of Achmea Group) currently shows a TV commercial where you can win a HomeWizard kit to improve safety around the house. They also organized an info-session with HomeWizard and they offer the stuff in their prevention shop. All good work!

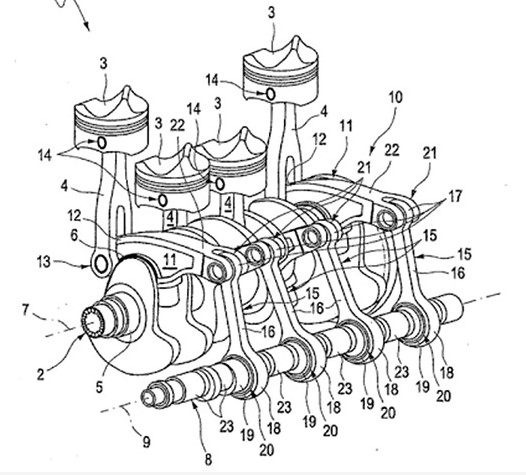

A new patent reveals Audi’s plans for a new hyper-efficient piston engine, which is planned to be as smooth as larger 6- and 8-cylinder engines. For more info see Fox News.

Yesterday Apple officially introduced the new iPhone 6 (Plus) and Apple Watch. After reading the first reviews it seems good stuff but nothing spectacular.

Last week I had a discussion again with an EU insurance company about how to work paperless (also without physical distribution of documents to the customer) and yet have to issue a Green Card (international certificate of insurance). Apparently there is still confusion about this.

Some friction between life cycles concluded by Nissan this week.